Content

If both companies record base on the old schedule, they need to make adjustments to ensure the ending balance reflects with new loan movement. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

Parts of the prepaid margin were reimbursed by the EFSF to Ireland and Portugal in 2016, as the margin had been set to zero for these loans. Effective-Yield Method on a Standard Fixed-Rate Loan The loan is a 10-year, $100,000 loan at 5% fixed, with a fee of $3,000 and costs of $2,000. Increased number of ARMs and hybrid loans during the real estate boom—problematic because accounting systems originally designed to handle Statement no. 91 for standard loans are inadequate to handle nontraditional loan products.

Deloitte comment letter on tentative agenda decision on IAS 23 — Borrowing costs on land

The face, or par value of a bond, is the amount paid by the issuer when the bond matures, assuming the borrower doesn’t default. The term of the loan is the maximum period of time during which regularly scheduled payments of principal and interest are due on the loan. The term of the loan is the maximum period of time during which regularly scheduled payments deferred loan costs of principal and interest will be due on the loan. If a monthly student loan payment is provided on the credit report, the lender may use that amount for qualifying purposes. If the credit report does not reflect the correct monthly payment, the lender may use the monthly payment that is on the student loan documentation to qualify the borrower.

This dashboard provides details on historical payment flows between the EFSF/ESM and programme countries (left-hand scale). Theblended lending rate for each country is displayed as a line (right-hand scale). Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms and their related entities.

What is Weighted Marginal Cost?

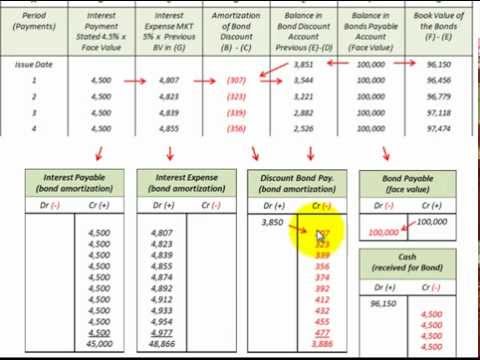

Continuing with the example, the annual issuance expense is $10,000 divided by 10, or $1,000. The journal entries to record this expense are to debit “debt-issuance expense” and credit “debt-issuance costs” by $1,000 each. Amortization is a noncash expense, which means it is added back to operating cash flow on the cash flow statement. All installment debt that is not secured by a financial asset—including student loans, automobile loans, personal loans, and timeshares—must be considered part of the borrower’s recurring monthly debt obligations if there are more than ten monthly payments remaining. However, an installment debt with fewer monthly payments remaining also should be considered as a recurring monthly debt obligation if it significantly affects the borrower’s ability to meet their credit obligations.

Are deferred loan costs an asset?

Rather, they are accounted for as a debt discount and amortized using the effective interest method. Under U.S. GAAP, transaction costs are deferred as an asset and amortized over the term of the debt using the effective interest method.